Uzone.id – Insurance, as we know it today, is very useful as a means of managing risk. By having insurance, we transfer the financial risk or loss that we should bear if something unexpected happens, to the insurance company. However, not many people know that insurance has a long history.

Over the centuries, insurance has developed into a modern business that protects society from various risks. This industry has been profitable for many years and has become an important aspect of long-term private and public finance.

Insurance begins with a basic insurance concept, namely mitigation of various risks or threats, which then develops and evolves along with the development of human civilization. For example, what happened in the past has saved many lives from threats, such as food shortages.

This incident occurred during the ancient Egyptian era ruled by the Pharaohs, which meant that 7 years was a period of abundance, and in the next 7 years, there would be a period of famine, namely a period of shortage of materials and food.

Then, King Pharaoh followed the advice of the Prophet Yusuf by setting aside food ingredients to get supplies for the Paceklik period, and as a result, the Egyptians did not lack food for the next 7 years.

Then in 1750 BC, archaeologists discovered a law created by the King of Babylon entitled the Code of Hammurabi. One of the points in the book is the following rule: traders who want to transport borrowed merchandise by ship need to pay a certain amount of money to get a guarantee, namely in the form of cancellation of the loan if the ship is stolen.

After that, in 600 BC, the Romans and Greeks created the first health and life insurance. This product provides care for the family left behind if the head of the family or breadwinner has died.

In the period after AD, in the 12th century in Anatolia, namely in the 1200s, a type of state insurance was created. The insurance products created are guaranteed by the state. So, a group of traders pays a premium to the state and the state treasury will replace the traders’ losses.

After that, an insurance agreement or what could be called a policy was created around the 14th century in Genoa. This policy, called “Independent insurance policy that is not tied to contracts or loans,” was first discovered in 1347.

In the following century, independent maritime insurance was established. The separation of insurance from contracts and loans was a major change that affected insurance in subsequent years.

Then we move forward to the 17th century, when fire was a constant threat in England. In 1666, there was a major fire in London which destroyed tens of thousands of homes and dozens of churches over 5 days.

From this incident, a doctor and contractor named Nicholas Barbon created the world’s first home fire insurance company to prevent this from happening.

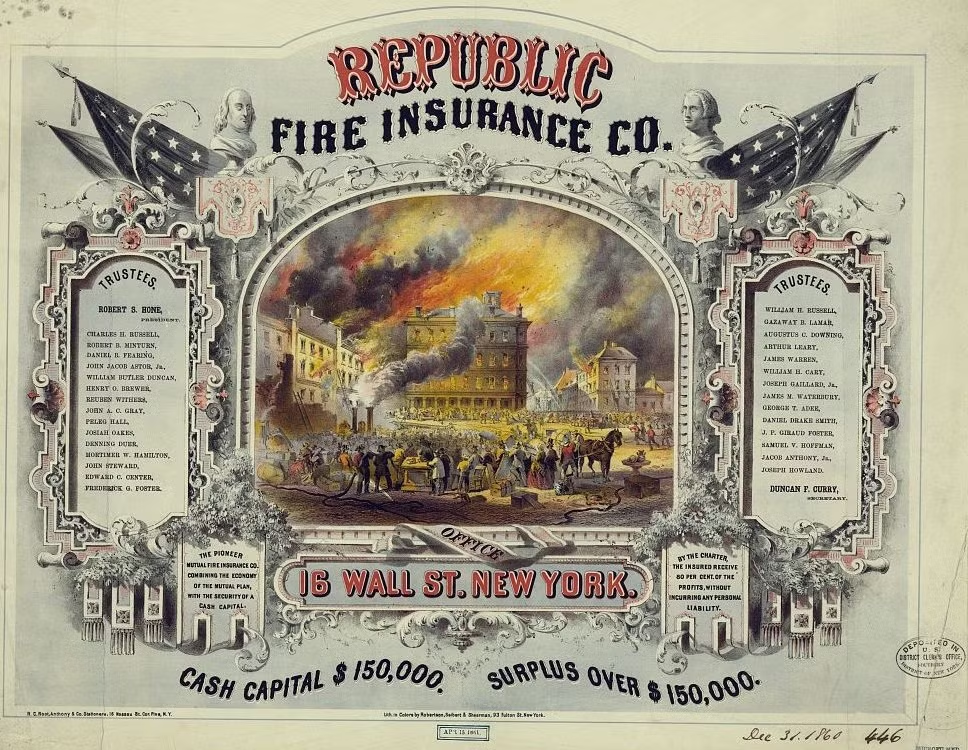

In the US, the first insurance company was founded in 1732 in South Carolina and offered fire protection. In the 1800s, fire insurance companies evolved to include life insurance and some other coverages.

In the 1800s, fire insurance companies expanded and included life insurance and several other insurance coverages to continue to grow rapidly and have many options for us to be protected.

Evolution of world insurance development:

The evolution of insurance concepts and services continued to develop in the following years, which later became known as the types of loss insurance that exist today, including:

Sea Freight Insurance (Marine Insurance)

Insurance for shipping by sea and land began to be implemented in Italy in the XII century. This custom was then brought by Italian traders to England around the XIII and XIV centuries.

These various records and events in the past were then compiled into the Marine Insurance Act 1906 (MIA 1906) which regulates the implementation of Marine Insurance. Maritime transport policies in Indonesia also refer to MIA 1906.

Fire insurance

Fire insurance was born in 1680, marked by the establishment of the first fire insurance company, namely The Fire Office or The Phoenix.

The existence of this fire insurance originated from a major fire that hit the city of London in 1666. The fire, which lasted for 4 days, caused huge losses so the rebuilding process was only completed in 1671.

Personal Accident Insurance (Personal Accident Insurance)

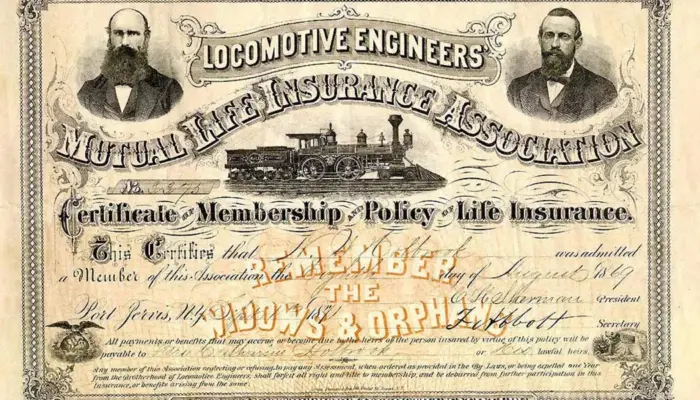

The birth of personal accident insurance began with the many accidents that occurred in the nineteenth century along with advances in technology and industry.

At that time, accidents occurred in the process of operating modern equipment, motorized vehicles, and trains.

In 1848, the first insurance company was founded, called The Railway Passenger Assurance Co, which covered the risk of personal accidents during train operations.

However, this type of insurance then developed and covered the risk of other personal accidents. Even at the end of the nineteenth century, this type of insurance guaranteed the risk of certain diseases. Furthermore, in the 20th century, coverage for hospital care costs was expanded.

Employer Liability Insurance (Employers liability insurance)

This insurance was born in 1880 after the Employers Liability Act came into effect. This law was then refined in 1897 with the publication of the Workmen’s Compensation Act because the Employers Liability Act 1880 did not fully guarantee that workers would receive security.

Furthermore, in 1906, this regulation which only applied to certain companies was further refined into WCA 1906 which applies to all types of companies.

Other Liability Insurance

The birth of the Employers Liability Act of 1880 was also the forerunner of liability insurance. The risk of a possible lawsuit from a third party began to be realized in 1875.

Therefore, the birth of the Employers Liability Act of 1880 at that time sparked the issuance of general liability insurance policies, especially for building contractors.

Burglary Insurance

The insurance company that pioneered this type of insurance was Mercantile Accident and Guarantee Insurance Co, which in 1889 issued its first policy. Previously, in 1897 a Lloyd’s Underwriter had agreed to expand fire insurance coverage by adding demolition risk.

Motor Vehicle Insurance

In 1898, the Law Accident Insurance Society created a form of motor vehicle insurance to follow up on the enactment of the Locomotive on Highways Act 1896 which allowed transportation via motor vehicles.

Furthermore, in 1930 the Road Traffic Act was published which became the basis for the implementation of mandatory third-party liability insurance. The reason is, that people who often suffer losses due to motorized accidents do not receive compensation from the vehicle owner.

Design and Build Insurance (Engineering Insurance)

This type of insurance covers risks when constructing or installing machines. This design and construction insurance was born in the 19th century due to frequent and violent boiler steam explosions.

In 1858, the first steam boiler insurance company was established to provide regular steam boiler inspection services as well as insurance protection.

Along the way, some regulations were born, such as the Explosion Act of 1882 and the Factories Act of 1937. In 1872, machine insurance (damage to steam engines) and electrical equipment insurance were born around 1897-1898, which was then followed by lift and crane insurance.

Aviation Insurance (Aviation Insurance)

In 1931, the insurance companies formed The British Aviation and General Insurance Co. Ltd and in 1935 formed The Aviation and General Insurance Co. Ltd.

The formation of the aviation insurance company was motivated by the high demand for insurance for the use of aircraft for civil transportation.