Dental coverage is not as complicated as people think. With proper guidance and accurate information, understanding dental coverage is easy. Let’s explore how these options affect your smile and overall health. First, it’s important to know that dental coverage involves paying a premium to a company to help cover the costs of dental maintenance and other care.

Is Dental Insurance Worth It?

Whether or not dental insurance is worth the expense is more than just a question of money. It’s a part of maintaining your overall health. Good oral health is linked to your overall health, and dental insurance is instrumental in helping keep it under control. Let’s examine more closely why dental insurance is not really an expense at all but a vital investment in your health.

Preventive Care: The Frontline of Oral Health

Dental coverage is typically your first line of defence, with a focus on preventive care. This includes cleanings, check-ups, and x-rays on a regular basis. These are valuable services, not just for maintaining oral health, but also for the early detection of any issues. Cleanings on a regular basis, for instance, stop the build-up of plaque, a primary cause of gum disease and tooth decay. Preventive care can also catch cavities sooner and prevent more complicated and costly procedures like root canals. Think of preventive care as the guardian that keeps the worst dental problems at bay.

More Than Cleanings: Major Dental Health Coverage

Most dental insurance policies extend beyond cleanings and check-ups. They typically cover a high percentage of the cost for more involved procedures like fillings, crowns, root canals, and even orthodontics and periodontics in some instances. This aspect of dental insurance is particularly valuable, as these procedures are quite expensive. Orthodontic work, for instance, isn’t simply a question of a more pleasing smile; it’s a question of correcting bite issues that will impact your overall dental health. Insurance that covers a percentage of these costs makes these treatments that much more accessible and less of a financial burden.

Dental Emergencies: A Safety Net

The second vital role of dental insurance is its role in emergency care. Dental emergencies can happen to anyone, and their treatment can be extremely costly. Whether it is a broken tooth or an acute infection, with dental insurance, you are not left to fend for yourself with a huge bill under unplanned circumstances.

Budgeting for Health

Most likely the most practical benefit of dental insurance is that it can make health care a planned expense. Instead of being surprised by a large dental bill, you have a predictable monthly premium that you can expect. This makes health care financial planning easier and less stressful. Regular dental expenses are a predictable portion of your budget, not an unwelcome surprise.

Long-Term Health Benefits

Investing in dental insurance is also investing in your long-term health. Poor oral health has been linked to numerous systemic health problems, including heart disease, diabetes, and stroke. By maintaining good oral health through regular dental care made possible by insurance, you’re potentially reducing the risk of these associated health problems.

Peace of Mind

Lastly, there is the intangible yet worthwhile advantage of dental insurance – peace of mind. Knowing that you and your family are covered for dental care can be a big relief and reduce a great deal of stress and anxiety. It makes dental health a priority and know that you have the financial backing to support it.

Dental coverage isn’t just a monetary transaction; it’s an investment in your health, well-being, and peace of mind. It ensures you don’t have to compromise on your oral health due to expense, and it keeps you prepared for both routine care and unforeseen dental needs.

Which is Better: PPO or HMO Dental Coverage?

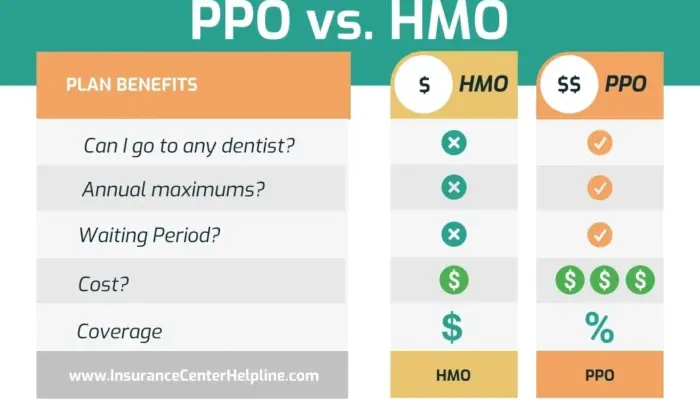

Choosing the right dental insurance plan is not only crucial to your oral well-being, but also to your financial health. The two most popular dental insurance plans are the Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO). Each has its own features, benefits, and limitations. Let us examine these plans more closely to help you determine which can be the better choice for your needs.

PPO: Flexibility and Freedom

PPO plans enjoy an extensive network of dentists. This variety gives you the liberty to choose a dentist according to your personal needs, whether it is location, specialization, or experience. Possibly the best advantage of a PPO plan is the ability to see dentists outside the network. This is particularly valuable if you have been seeing a dentist who is not in the plan’s network or if you need specialized care that is not available within the network. In a PPO plan, the insurance company typically pays the dentist directly, reducing your upfront costs. PPO plans provide more choice and freedom, but the deductibles and monthly premiums are also more. This is the trade-off for the more flexibility and wider range of choices PPO plans provide.

HMO: Structured and Cost-Effective

HMO plans have lower monthly premiums. This makes them a great option for individuals and families looking for inexpensive dental coverage. Most HMO plans not include annual maximums, so there is no restriction on the amount they will pay toward your dental care throughout the year. HMO plans require you to choose a dentist from a specific network. While this can limit your choices, the networks are typically large, with a great variety of dentists to choose from. However, if you do seek care outside of this network, it typically is not covered, unlike PPO plans. The streamlined cost structure of the HMO plan is a major advantage, but with that comes reduced flexibility. If you are not bothered about choosing a dentist from a pre-selected network and appreciate lower monthly costs, an HMO plan could be a suitable choice.

Making Your Choice: PPO vs. HMO

In the end, it’s about your personal needs and preferences when deciding on which dental insurance plan you choose. If you want flexibility and a larger choice of dentists, and does not have problem paying higher premiums, then a PPO plan is best for you. But if price is your number one priority and you do not mind choosing a dentist from a network, then an HMO plan can be an ideal option.

Both plans have their respective advantages, and being aware of these will allow you to make an intelligent decision. Remember, the best dental insurance plan is one that not only fits your budget but also adequately meets your dental care needs.

Making Sense of Dental Coverage

The best way to get the most out of your dental coverage is to understand its many features. For starters, most insurance companies have various plans that cater to the needs and circumstances of various individuals. In addition, dental benefits accumulate in a benefit period, usually one year (though not necessarily a calendar year). There is much to learn about dental coverage, so here are some points to provide a better understanding of it, in the event there are any leftover benefits prior to the end of the year.

Maximums

Most dental plans have an annual maximum, which is the dollar amount a dental plan pays toward the cost of dental care within a specific period, despite the fact that the cost of a patient exceeds the limit. The patient is personally responsible for paying amounts over the annual maximum. A common annual maximum is $1000 or $1500 while others are $2000 or $3000. These can be individual or family maximums.

Deductibles

Most plans have a dollar deductible. You are responsible for the cost of dental care before a third party is obligated to pay benefits. That is, you have to pay a portion of your bill yourself before your benefit plan will pay its share of your costs. Plans vary—for example, some plans charge the deductible for diagnostic or preventive services and some do not. The deductible may be a one-time fee, or it may vary depending on the program.

Coinsurance

A coinsurance provision is found in most plans, where the benefit plan pays a set percentage of your treatment expense. The amount you pay is called coinsurance—this is paid even after deductible has been satisfied. For example, you can pay 20 percent while your plan can pay 80 percent of the expenses.

Reimbursement

The majority of dental plans offer different classes of coverage. Each class offers a percentage of coverage and exclusions and limitations. Your plan might be different, so it is ideal to check your benefits carefully. For example, Class I can offer coverage under the highest percentage—at least 80-100 percent of the plan’s maximum allowance. Class II may cover only minor services like fillings, extractions, and periodontal treatment, and reimbursements generally range from 70-100 percent. Class III usually reimburses at a lower level at 50 percent and may include a waiting period before services are covered.

Estimates

You can ask your dentist to complete and submit a request for a cost estimate. They are also referred to as pre-treatment estimates. This will inform you in advance what procedures are covered, but it is not a payment guarantee.

Exclusions

Exclusions are dental services that are not covered by your plan. Dental plans are sometimes designed to help pay for dental care and may not cover every need, and such are referred to as limitations or exclusions. Some groups of health restrict coverage for dental pre-existing conditions that are in place before a patient enrolls in a plan, for instance, a missing tooth.