When it comes to life insurance, two of the most popular types are Term Life Insurance and Whole Life Insurance. While both offer financial protection for your loved ones, they work in very different ways, each with its own set of advantages and disadvantages. Understanding the key differences between these two types of insurance is essential to making an informed choice that aligns with your financial goals and family’s needs.

In this article, we’ll break down Term Life Insurance and Whole Life Insurance, compare their pros and cons, and help you decide which one offers the best protection for you.

1. What is Term Life Insurance?

Term Life Insurance offers coverage for a set period (10, 20, or 30 years). If you pass away during the term, your beneficiaries receive the death benefit. If the term ends and you’re still alive, no payout is made.

Key Features:

- Fixed Duration: Coverage for a specific term (e.g., 10, 20, or 30 years).

- Affordable Premiums: Typically lower premiums than whole life insurance.

- No Cash Value: No accumulation of cash value.

- Renewal & Conversion: Some policies allow renewal or conversion to whole life at a higher premium.

Advantages:

- Lower Premiums: Affordable for budget-conscious individuals.

- Simple: Easy to understand with no complex components.

- Flexible: Choose the term length that fits your needs.

Disadvantages:

- No Lifetime Coverage: Coverage ends when the term expires.

- No Cash Value: No investment growth or cash value buildup.

2. What is Whole Life Insurance?

Whole Life Insurance is a permanent policy that covers you for life, as long as premiums are paid. Unlike term life, it includes a cash value component that grows over time and can be accessed through loans or withdrawals.

Key Features:

- Lifetime Coverage: Coverage lasts for your entire life.

- Cash Value Accumulation: A portion of premiums builds tax-deferred cash value.

- Fixed Premiums: Premiums remain the same throughout the policy’s life.

- Dividends: Some policies offer dividends that can be reinvested, used to pay premiums, or withdrawn.

Advantages:

- Lifetime Protection: No expiration, providing peace of mind.

- Cash Value Growth: Cash value grows over time and can be accessed.

- Fixed Premiums: Stable, predictable premiums.

- Potential Dividends: Some policies provide dividends, offering extra financial benefits.

Disadvantages:

- Higher Premiums: More expensive than term life insurance.

- Complexity: Cash value and investment components may be hard to understand.

- Slow Cash Value Growth: Cash value accumulates slowly, especially in the early years.

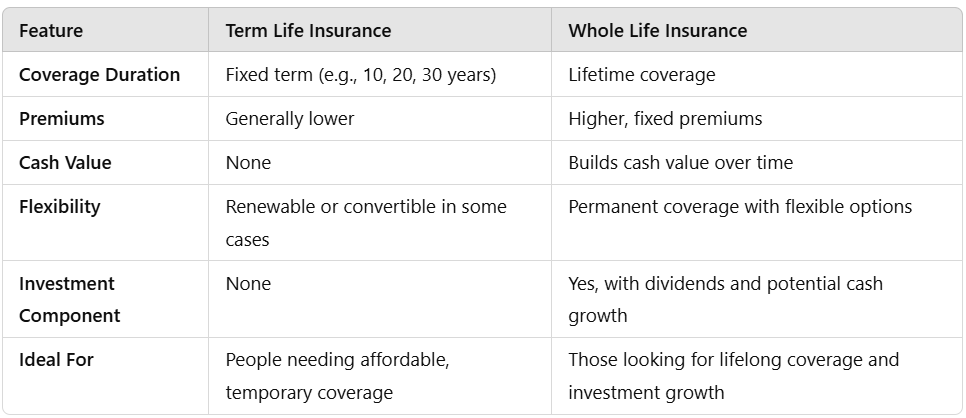

3. Key Differences Between Term Life Insurance and Whole Life Insurance

To help you make a clearer choice, here’s a comparison of the main differences between Term Life and Whole Life insurance:

4. Which One Is Right for You?

Choosing between Term Life Insurance and Whole Life Insurance depends on your financial goals, family situation, and budget. Here are some factors to consider:

- If you need affordable coverage for a specific period, such as until your children are grown or your mortgage is paid off, Term Life Insurance may be the better option.

- If you want lifelong protection and are interested in accumulating cash value, Whole Life Insurance could be a great fit, especially if you can afford the higher premiums.

- Consider your budget: Term life is ideal for those looking for temporary protection with a lower cost, while whole life suits those seeking long-term coverage with an investment component.

5. When to Choose Term Life Insurance

- You’re young and healthy and want affordable coverage.

- You need coverage for a specific period, such as during your child-rearing years or until your debts are paid off.

- You prefer a simple, straightforward policy without any complicated investment components.

6. When to Choose Whole Life Insurance

- You want lifelong coverage and are interested in building cash value.

- You’re looking for a policy that acts as both insurance and an investment.

- You have the budget to pay higher premiums and appreciate the stability of fixed costs.

Conclusion

Both Term Life Insurance and Whole Life Insurance provide valuable protection, but they serve different needs. Term Life Insurance is perfect for those seeking affordable, short-term coverage, while Whole Life Insurance is ideal for those who want lifelong protection and the added benefit of accumulating cash value.

By carefully evaluating your financial situation, goals, and family needs, you can make the best decision for your life insurance coverage.